Sam Altman’s AI Bubble Warning

When Sam Altman, CEO of OpenAI, warned that artificial intelligence might be in a bubble, his words echoed through Silicon Valley and Wall Street alike. The concern is not hypothetical: investors are pouring unprecedented sums into AI, yet measurable productivity and financial returns remain far less than expected.

A 2023 study from MIT found that 95 percent of companies attempting to deploy AI applications failed to generate profits. McKinsey’s March 2025 survey echoed this finding: while 71 percent of firms reported using generative AI, more than 80 percent said they had seen no “tangible impact” on earnings. Meanwhile, Gartner placed AI squarely in the “trough of disillusionment” in its latest hype cycle report, a stark signal that expectations have run far ahead of real-world outcomes.

Yet stock markets tell a different story. U.S. equity growth has been dominated by the so-called “Magnificent Seven” Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Since 2024, these firms have collectively spent more than $560 billion on AI-related capital expenditures, while generating only about $35 billion in AI-driven revenue. OpenAI and Anthropic, valued at $300 billion and $183 billion respectively, remain unprofitable despite projected revenues of $13 billion and $2-4 billion this year.

This gap between investment and returns has sparked a crucial debate: if AI is indeed in a bubble, who will survive when it bursts?

Not All AI Is Created Equal

The AI industry is often treated as a single block of innovation. In reality, it divides into two fundamentally different categories of companies, with diverging risk profiles in a potential bubble.

1️⃣AI Infrastructure Companies

These firms provide the essential building blocks of the AI ecosystem:

- Data infrastructure: Scale AI, Appen, and increasingly Flitto.

- Compute and chips: Nvidia.

- Cloud and data platforms: AWS, Databricks, Snowflake.

- Model APIs and services: foundational LLM access layers.

Key advantages:

- High entry barriers: Scalable pipelines for data, compute, and quality cannot be easily replicated.

- Durability: Regardless of hype cycles, applications cannot function without infrastructure.

- Value capture: McKinsey and IBM analyses of prior technology waves show that infrastructure layers consistently retain the most sustainable value.

2️⃣AI Application Companies

These are the consumer-facing or enterprise-facing products that sit on top of infrastructure:

- Generative chatbots (Jasper, Copy.ai).

- Image and video generation platforms (Runway, Synthesia).

- Specialized vertical apps (writing assistants, design tools).

Challenges:

- Low switching costs: Customers can change providers quickly when a cheaper or slightly better app appears.

- Rapid commoditization: Dozens of generative writing startups collapsed virtually overnight after ChatGPT launched.

- Shorter life cycles: Applications are highly exposed to hype swings.

🧑🏫Expert Perspective

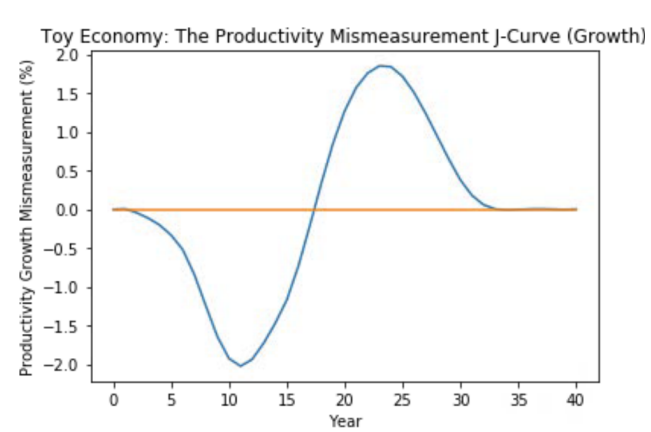

Stanford economist Erik Brynjolfsson explains this dynamic using the “productivity J-curve.” In early adoption, productivity can actually decline as organizations struggle to integrate new technologies. Only later, after deep adaptation, do productivity gains materialize. Infrastructure enables this adaptation, while applications are often disposable.

Why Infrastructure Wins, and the Rise of Voice Data

The logic of infrastructure resilience is not new. During the dot-com bubble of the late 1990s, thousands of flashy consumer-facing websites went bankrupt. But infrastructure providers, Cisco, Intel, and later Amazon’s AWS, endured and became the backbone of the internet economy.

A similar pattern is now playing out in AI.

- Nvidia is the only Magnificent Seven company already showing large AI-driven profits, thanks to its dominance in GPUs.

- Scale AI has become indispensable for training dataset infrastructure, securing long-term government and enterprise contracts.

- Databricks and Snowflake continue to thrive by enabling others’ AI experiments through their cloud data platforms.

By contrast, dozens of highly valued AI apps have collapsed in just the past two years.

But infrastructure today extends beyond chips and text. Increasingly, voice data is emerging as a critical foundation for the next wave of AI.

Why Voice Data Matters

- Voice as the next interface: As AI expands into Physical AI, robots, autonomous vehicles, IoT devices, AR/VR, the default mode of interaction will be speech. Machines must be able to process commands in multiple languages and accents to function effectively.

- Exploding demand: Flitto’s CEO, Simon Lee, recently reported a surge in global demand for voice datasets. The company now generates its largest overseas revenue in the United States, has turned profitable in Japan, and is expanding operations in Shanghai, China.

- Uneven availability: Not all voice data is created equal. Children’s speech, for example, is drastically underrepresented, making AI recognition models unreliable. Dialects and low-resource languages are similarly lacking. Even Google Translate fails to support voice input for many languages, despite allowing text entry.

These shortcomings reveal a major opportunity: companies that can supply diverse, high-quality voice data will be indispensable in the Physical AI era.

Flitto as a Language and Voice Data Infrastructure Company

Flitto is best known for its Live Translation (LT) and Chat Translation (CT) services, but these are only the consumer-facing surface. The company’s true strength lies deeper: as a global infrastructure provider of language and voice data.

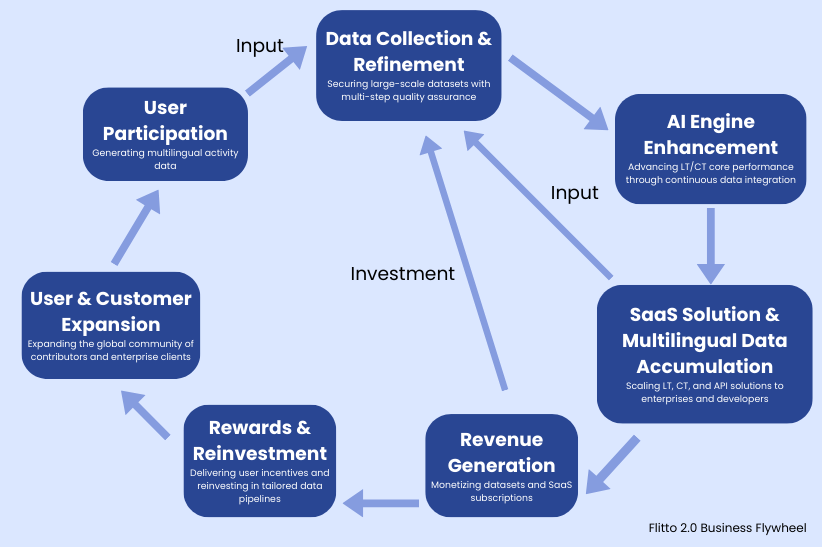

The Flitto Data Flywheel

- User Participation

14 million global users continuously generate multilingual activity data through translation, content creation, and voice collection missions. - Data Collection & Refinement

Proprietary pipelines refine, validate, and curate these raw inputs into high-quality multilingual datasets with multi-step quality assurance. - AI Engine Enhancement

Continuous integration of refined datasets advances the performance of Flitto’s Live Translation (LT) and Chat Translation (CT) engines. - SaaS Solution & Multilingual Data Accumulation

LT, CT, and API solutions are scaled to enterprises and developers, accumulating more multilingual data in the process. - Revenue Generation

High-quality datasets and SaaS subscriptions are monetized, turning multilingual corpora and voice data into commercial value. - Rewards & Reinvestment

Revenues fuel tailored user incentives and further reinvestment into data pipelines, motivating ongoing participation. - User & Customer Expansion

This cycle expands both the global contributor community and enterprise client base, reinforcing Flitto’s network effects.

This cycle differentiates Flitto from both big tech and smaller competitors.

Differentiation from Global Players

- Appen: Large-scale crowdsourcing but weaker in real-time data and multilingual diversity.

- CrowdWorks (Japan): Domestic strength but limited global reach.

- Flitto: Combines global reach, multilingual coverage, and fresh, real-time voice data unmatched by peers.

Beyond Real-Time: Customized AI Translation

Flitto goes beyond standard translation services by offering customized AI interpreters. Enterprises can provide an executive’s past speeches, documents, or terminology, and Flitto builds a personalized interpreter aligned with that individual’s speaking style and organizational context.

This capability explains why Flitto’s solutions are frequently selected for major international conferences, where real-time, high-accuracy interpretation is non-negotiable.

Strategic Significance

Physical AI: As robotics and IoT adoption grows, the need for reliable multilingual speech recognition will intensify. Flitto’s infrastructure positions it as a global leader in this domain.

Sovereign AI projects: Flitto is a key participant in Korea’s Upstage SOLAR LLM consortium, one of five finalists in the government’s foundation model initiative. Similar sovereign AI efforts in Europe and Japan are also expanding.

Flitto’s Position in an AI Bubble Scenario

So what happens if the AI bubble bursts?

- In a contraction scenario: Application startups will likely collapse, but demand for data infrastructure,especially text and voice datasets, will remain.

- In a growth scenario: Infrastructure providers will scale with adoption, capturing value as enterprises integrate AI at deeper levels.

Either way, infrastructure survives. And voice data infrastructure, in particular, is set to expand as AI moves from digital to physical worlds.

Infrastructure Endures

The question of an AI bubble is less about if and more about when. But one truth is clear: AI cannot function without data.

The surge in demand for language and voice data demonstrates that even as some parts of AI may be overvalued, the foundation remains critical. Voice is emerging as the universal interface for AI, from chatbots to robots, and companies that can deliver diverse, high-quality speech datasets will define the next decade.

Flitto has already shown this trajectory:

- Growing overseas revenues in the U.S., Japan, and China.

- Providing multilingual and voice datasets that global big tech still struggles to match.

- Powering sovereign AI projects like Korea’s SOLAR LLM initiative.

If the bubble bursts, many flashy applications will vanish. But infrastructure companies, those that build the pipelines, supply the data, and enable AI’s real-world use, will endure.

Flitto is not simply riding the hype. It is laying the bedrock.